FINANCIAL WISDOM PLATFORM

Designed to make project valuation as easy to use and understandable as possible. Here is how it works

FREE TRIAL

Take a peak

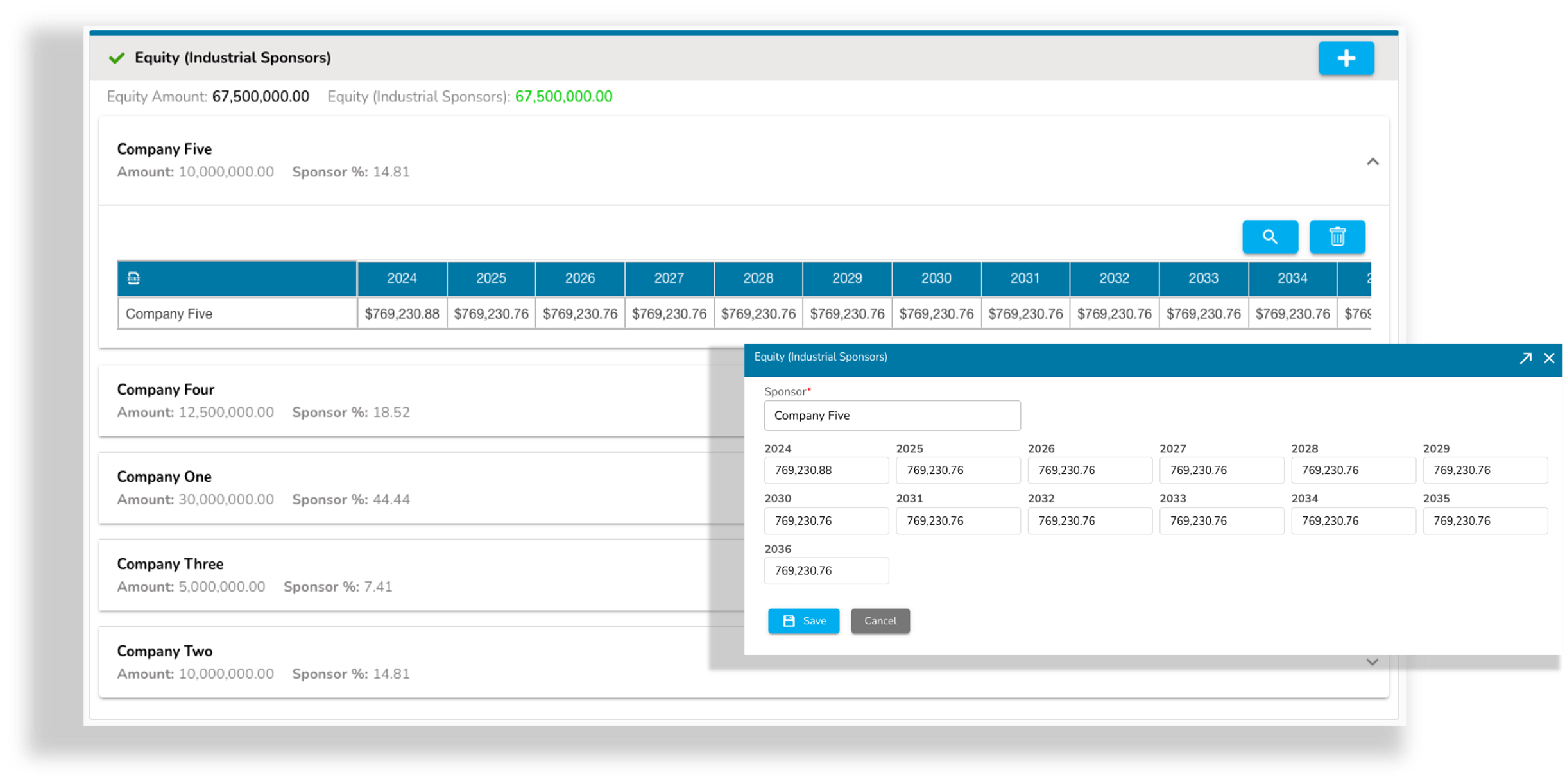

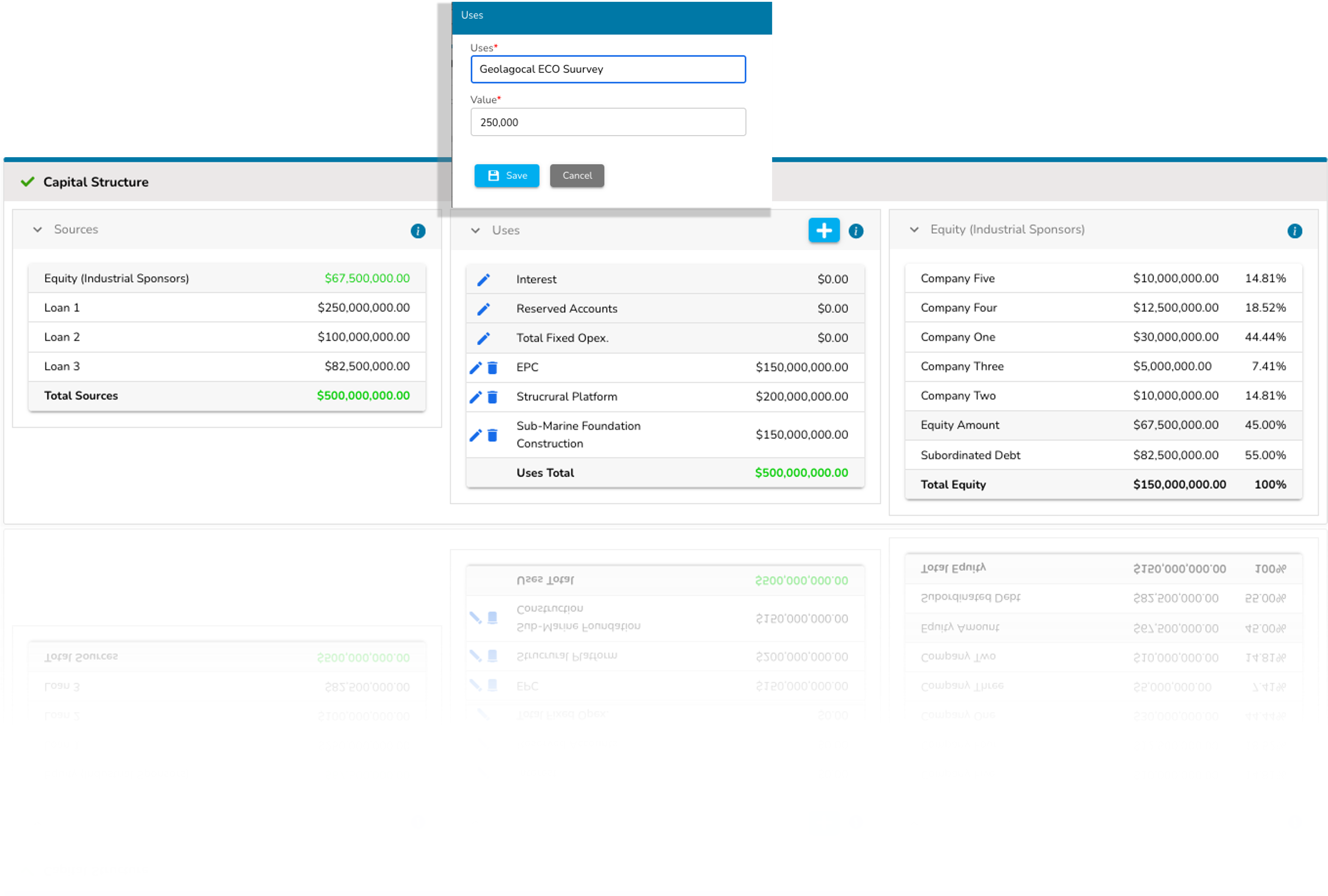

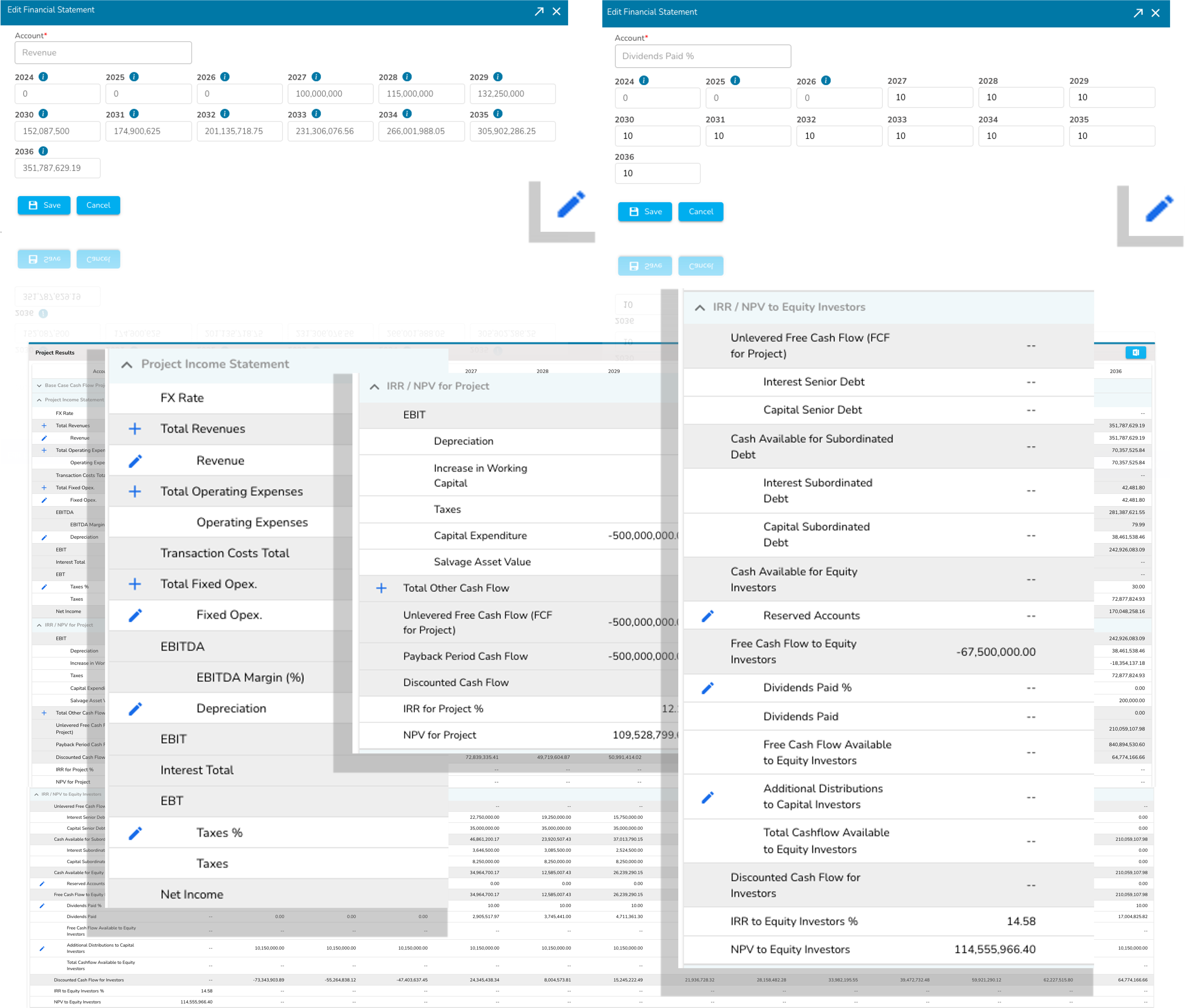

Adding equity distribution as the sources of funding for the project. Reflecting capital invested by individuals, venture capitalists, private equity firms, or other entities seeking a return on their investment. Investor equity, along with other sources of financing like debt or grants, provides the necessary funds to initiate and sustain the project.

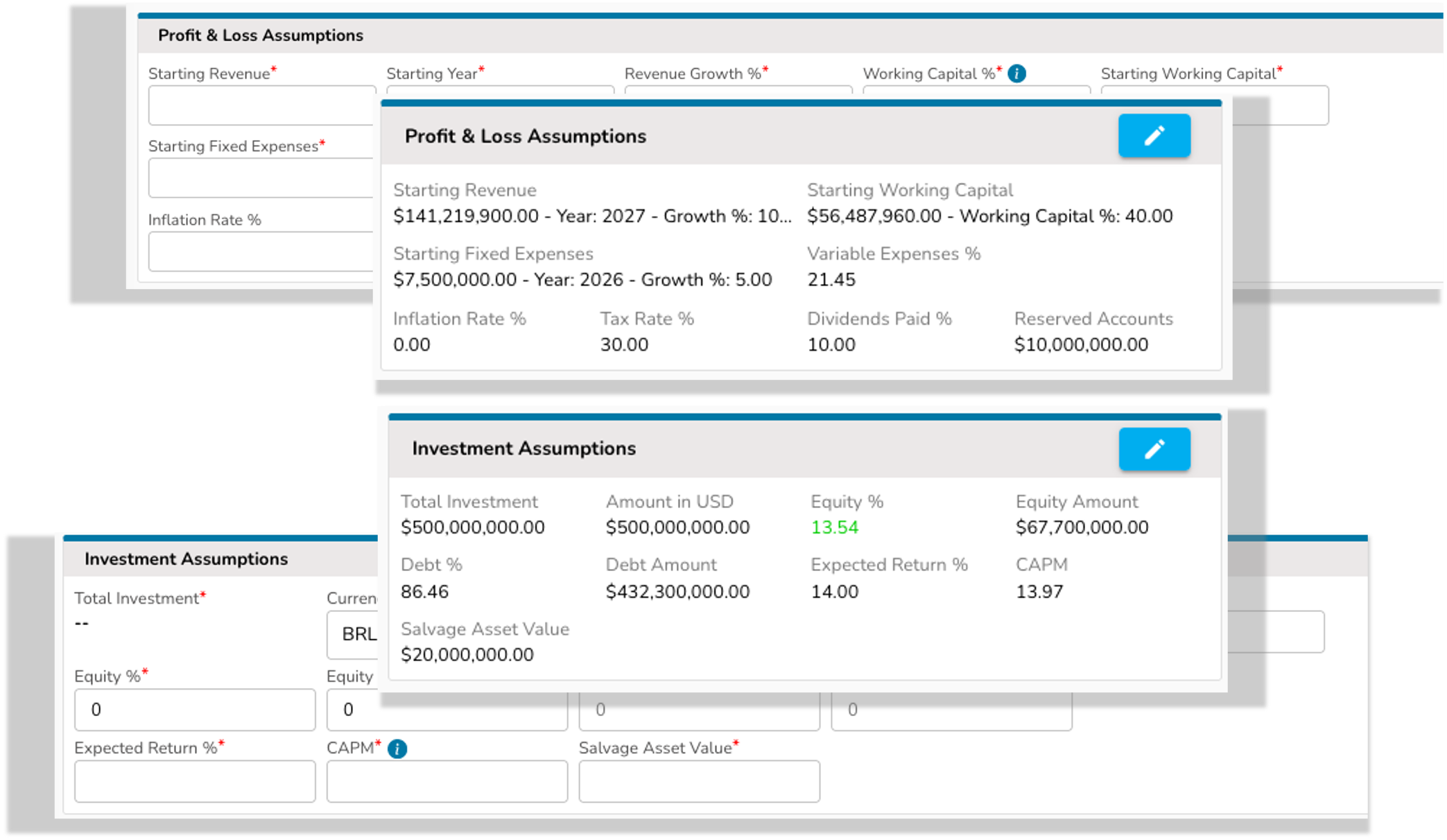

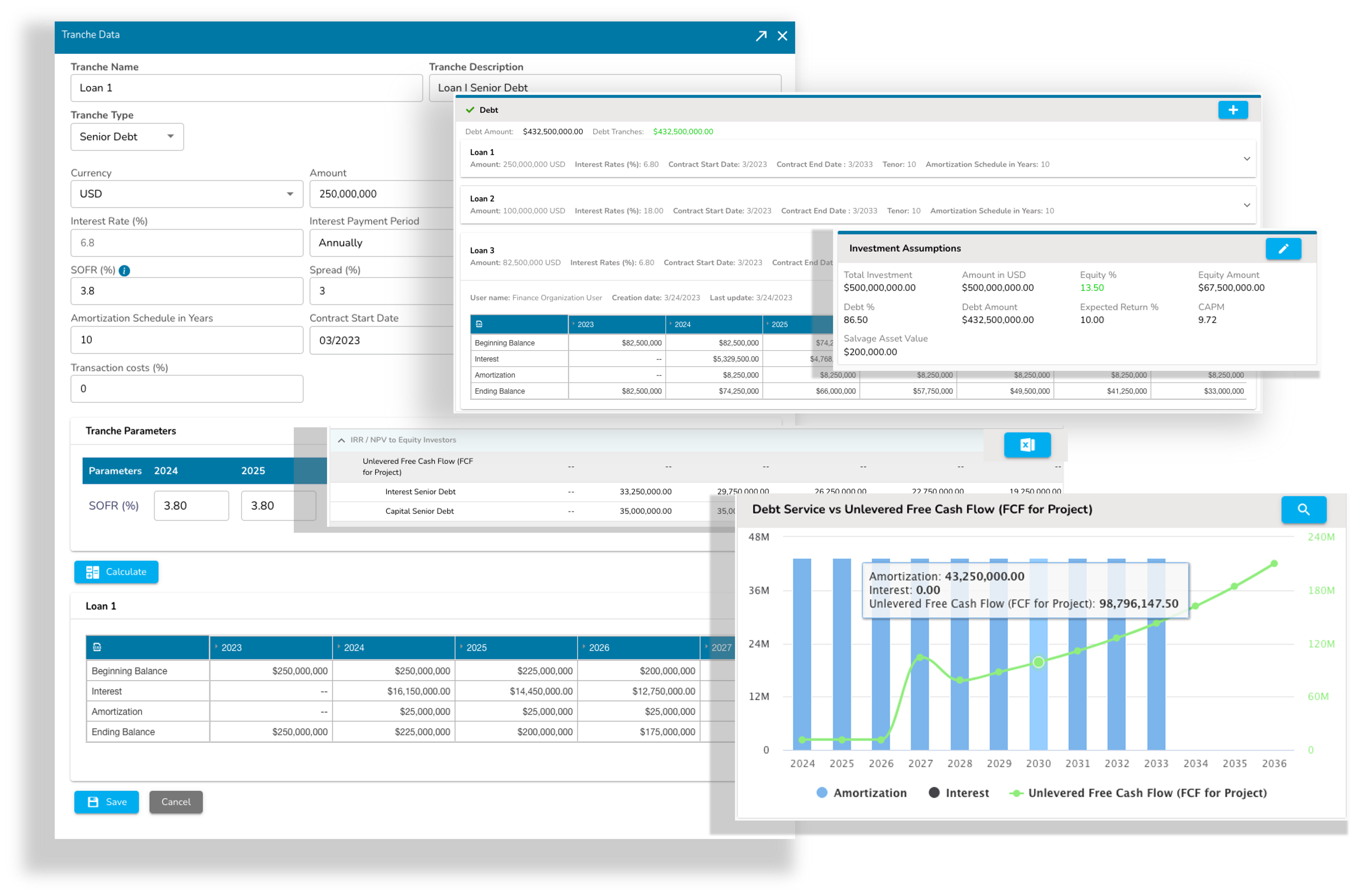

All necessary elements to determine the project financial feasibility, potential returns, risks, profitability, and overall attractiveness of the investment opportunity.

Don't wait to reveal your project's profitabulity potential, we offer a seamless experience for computing the true value of your investment, that allows you to understand the key financial drivers for projects viability by meeting all your assessment neds.